Key Takeaways

- When someone passes away, their assets may need to be distributed in probate court. The probate system validates Wills, gives authorization to estate representatives, and more. The process of distributing property after someone’s death is called probate administration when there is a valid Will, or estate administration when there is no Will. Importantly, not all assets will need to go through probate court. Ask an NYC lawyer about which assets will and will not go through probate.

- Probate laws differ from state to state, so it is advisable to work with a skilled attorney when facing probate court after a family member’s passing.

- To begin the probate process, you must file a petition in the county where your relative lived at the time of their passing to appoint an executor.

- Executors are entitled to compensation for estate and probate administration but may face liability for mismanagement if they fail to manage the assets correctly.

- It may be possible to object to the deceased’s Will if you disagree with who will serve as the executor or who will receive certain assets, for example. However, certain stipulations apply for which parties can object to the Will, so you will want to check with an attorney whether you meet those requirements before attempting to object a Will.

- You may have to pay between 2 and 7% of the estate’s total value in probate administration fees. You can better understand of estimated cost and duration for your specific case by reaching out to an attorney.

How Experienced Probate Attorneys Can Help

An estate administration lawyer, also known as a probate attorney, can guide you through the estate administration process.

The Probate & Estate Administration Process

What happens to a loved one’s assets after death? They pass on to his or her designated beneficiaries if there is a Will or their statutory distributees (next of kin) if there is no Will.

The probate court system, the Surrogate’s Court in New York, is in charge of validating wills, authorizing estate representatives to act, and managing any objections from the parties. The process of distribution is called probate administration when there exists a valid will or estate administration when there is no will.

The complexity of dealing with an estate often requires the help of an estate administration lawyer.

State laws vary when it comes to probate administration. In addition, every person’s case is unique.

How to Probate a Will in the State of New York

- File a petition to appoint an executor. This is a person who will make sure the estate is distributed according to the deceased person’s will. This petition begins the probate process. You must do this in the county where your loved one resided at their time of death.

- Obtain waivers and consent from statutory distributees pursuant to EPTL § 4-1.1 (in probate and administration proceedings) or ask for a citation date.

- Give notice of probate to beneficiaries under the will who are not distributees.

- Pay the Filing Fee based on the value of the estate.

- Obtain Letters Testamentary or Letters of Administration (if no will).

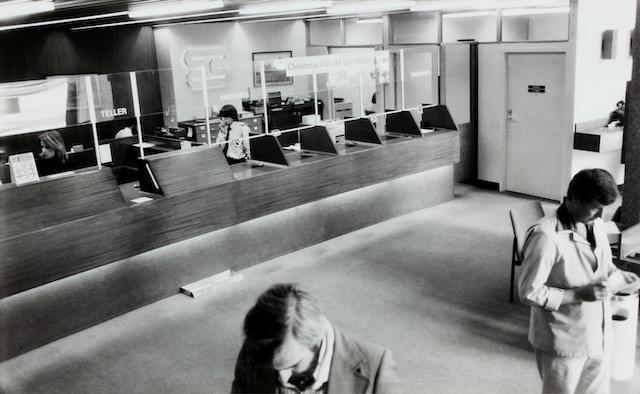

- Open an estate bank account.

- Thereafter, the executor or administrator makes an inventory of all assets in the estate and have them appraised if necessary.

- Gather and sell estate assets.

- Collect all debts owed to the estate, and pay any debts that the estate owes.

- Pay estate taxes, if applicable.

- Distribute assets to distributees (if there’s no will) or beneficiaries under the will.

- Have distributees or beneficiaries file releases.

- Gather all receipts and records to submit an accounting. Petition the court to close the estate.

Objections to the Will During Probate Administration

It is possible for someone to object to the deceased’s will. Disputes may arise over who will serve as the executor, or who will receive certain assets.

Note that you can only file an objection if you have legal standing to do so. Legal standing means you would benefit in some way by objecting.

Non-Probate Assets

Some assets do not go through the estate administration process. These are called “non-probate assets” and include:

- Property that is co-owned. Such as a joint bank account or a deed with “joint tenancy with right of survivorship”). This property will belong to the co-owner by law.

- Bank accounts that have “pay on death” or “in trust for” stipulations.

- Retirement accounts, such as IRAs and 401(k)s, and life insurance policies that have designated beneficiaries.

- Property held by a Revocable Living Trust. Successor trustees gain the title and all property in the trust.

Getting Compensated for Serving as Executor

One of the most common questions people ask probate lawyers is whether they will be compensated for serving as executor. The answer is yes, acting as an executor or administrator of an estate is time consuming! Executors and Administrators are entitled to statutory fees based on the size of the estate. They are also reimbursed for legitimate costs paid out of pocket. Even if you hire an estate attorney, you are entitled to the statutory compensation – unless the will says otherwise.

Note that if you serve as executor, it’s crucial that you manage the assets under your care correctly. Otherwise, you can be held liable for mismanagement. This is why it is important to seek the advice of a knowledgeable estate administration lawyer before getting started.

Cost and Duration of Probate

The cost and amount of time the estate administration process will take depends on several factors, including:

- The value of the estate

- The existence of a Will

- Location of estate properties

- How difficult it is to find and contact blood relatives

- Whether there are disputed debts

- Whether it will be a contested proceeding

- Appraisal, court, and accounting costs

- Whether there are testamentary trusts

The bottom line? When there are no disputes, probate takes about 9 to 18 months to complete. You can expect to pay 2% to 7% of the estate’s total value in fees related to probate administration. However, you’ll be able to gain a better understanding of cost and duration for your specific case by consulting with an estate administration lawyer.

Frequently Asked Questions

In order to contest a Will‚ one has to have legal “standing” to raise objections. This usually occurs when‚ for example children are to receive disproportionate shares under the Will‚ or when distribution schemes change from a prior Will to a later Will. In addition to disputes over the tangible distributions‚ Will contests can be a quarrel over the person designated to serve as Executor.

Probate is primarily a process through which title is transferred from the name of the deceased to the names of the beneficiaries.

Certain types of assets are what is called “non-probate assets” do not go through probate. These include:

- Property in which you own title as “joint tenants with right of survivorship”. Such property passes to the co-owners by operation of law and do not go through probate.

- Retirement accounts such as IRA and 401(k) accounts where there are designated beneficiaries.

- Life insurance policies.

- Bank accounts with “pay on death” (POD) designations or “in trust for” designations.

- Property owned by a living trust. Legal title to such property passes to successor trustees without having to go through probate.

Executors are reimbursed for all legitimate out-of-pocket expenses incurred in the process of management and distribution of the deceased estate. In addition, you may be entitled to statutory fees‚ which vary from location to location and on the size of the probate estate. The Executor has to fulfill his or her fiduciary duties on behalf of the estate with the highest degree of integrity and can be held liable for mismanagement of estate assets in his or her care. It is advised that the Executor retain a probate administration lawyer and an accountant to advise and assist him with his or her duties.

The cost and duration of probate can vary substantially depending on a number of factors such as the value and complexity of the estate‚ the existence of a Will and the location of real property owned by the estate. Will contests or disputes with alleged creditors over the debts of the estate can also add significant cost and delay. Common expenses of an estate include executors fees‚ attorneys fees‚ accounting fees‚ court fees‚ appraisal costs‚ and surety bonds. These typically add up to 2% to 7% of the total estate value. Most estates are settled though probate in about 9 to 18 months‚ assuming there is no litigation involved.

Dying without a last will and testament is called dying intestate. If you die intestate, your assets will be distributed according to the laws of intestacy in your state. Who your “distributees” are depends upon your family situation. In New York State, if you were married, but had no children, your spouse inherits all of your assets. If you had children but no spouse, your assets will be divided between your children. If you are survived by a spouse and children, your spouse inherits the first $50,000 of your assets, and the remaining assets are split evenly between your spouse and children. There are specific rules for each other family situation, and matters of intestate succession can become very complicated, often necessitating kinship hearings and the expertise of genealogists.

If you die having a last will and testament, any assets in your sole name at the time of your death pass through probate. Certain types of assets, called “non-probate assets,” bypass the probate process and go directly to beneficiaries. These non-probate assets include jointly titled properties, retirement accounts which have designated beneficiaries, life insurance policies with designated beneficiaries, bank accounts with clear designations, and properties owned by living trusts.

The Executor of an estate is the person you name in your last will and testament to act on behalf of your estate. Your executor is entrusted with the responsibility of marshaling your assets, paying your creditors, and distributing assets as stated in your will.

You name your executor in your Will. The Will must then be “probated”, meaning a petition must be brought in Surrogate’s Court. The Surrogate’s Court then validates the Will and issues “letters testamentary” to your executor, giving him or her the legal authority to marshal assets, open an estate bank account, pay creditors, sell assets and distribute assets according to the directions set out in the Will.

When a person dies without a will, assets owned in that person’s sole name are administered through the Surrogate’s Court in a process known as Administrative Proceeding. This is similar to a probate proceeding, but instead of a named executor, the Administrator is appointed according to statutory order of priority as set forth in Surrogate’s Court Procedure Act § 1001. The highest priority is given to the spouse, then children, grandchildren, parents, siblings. If a higher priority relative does not wish to serve as administrator, he or she can waive that right in favor of another person.

The deceased’s spouse has priority to receive what are called letters of administration. In second marriage situations where the children of the first marriage do not get along with the spouse in the second marriage, there is potential for discord. However, unless there are grounds to disqualify the spouse if he or she is incapacitated, doesn’t live in the United States, or is a felon or otherwise deemed incapable of fulfilling administrative duties there’s little chance of dislodging the spouse as administrator. Attempting to do so often results in costly delays.

In order for a will to be valid in New York State, it must be signed by the testator the person for whom the will is drafted acknowledged as the testator’s last will and testament to two witnesses who are not beneficiaries under the will, the witnesses must sign their names within thirty days of each other, and the testator must have testamentary capacity.

In NYS, a person has testamentary capacity if he or she is over 18 years of age, knows the extent of the property he or she owns, knows the natural objects of his or her bounty (i.e. identity of close family members who would naturally be left assets), and understands how the assets are to be distributed and to whom upon death.

A will is only valid after is has been admitted to probate. Only when the will has been probated in Surrogate’s Court and the executor issued “Letters Testamentary” will the executor have the authority to act.

Probate is the legal process for administering a person’s will and transferring titles from the deceased to their beneficiaries. For the will to be legally valid, it must be “admitted to probate” by the Surrogate’s Court in the county in which the decedent died.

The probate process begins when three things are filed the Surrogate’s Court: the original will, a certified copy of the death certificate, and a probate petition. The Surrogate’s Court charges a fee for filing the probate petition which is based upon the value of the estate. After jurisdiction is complete and all issues have been addressed, the Surrogate’s Court will issue a decree granting probate and Letters testamentary will be issued to the executor(s) named in the will.

Letters testamentary is the document which gives an executor the authority to administer the decedent’s estate. The Surrogate’s Court issues a decree granting probate and letters testamentary after jurisdiction is complete and all legal issues have been addressed.

Letters of administration are issued by the Surrogate’s Court to the administrator who will handle the assets of a decedent when he or she had left no will.

The cost and duration of probate can vary substantially depending on the value and complexity of the estate, whether there’s a will, and any will contests that might arise from creditors. Common expenses, which might add up to between 2% to 7% of the total estate value, include commissions, attorneys, fees, accounting fees, appraisal costs, and court fees.

Most wills dispense with the need for the executor to post a bond. However, in order to protect against the possibility that an executor or administrator might misappropriate assets, the Surrogate’s Court may require the administrator of an estate to be bonded. The bond is essentially an insurance policy issued by a bonding or surety company that provides security for the estate assets.

The surety company requires that the administrator has a solid financial and credit background, without criminal convictions or past bankruptcy filings. If the prospective administrator cannot obtain a bond, he or she would be required to surrender their appointment to someone who can satisfy the surety company’s requirements.

The responsibilities of an executor are set forth in the decedent’s last will and testament, or, if the will is silent or there is no will, in the Surrogate’s Court Procedure Act. The executor or administrator is responsible for collecting the decedent’s assets, pay the decedent’s creditors, and distribute the assets to the rightful beneficiaries. This may include cleaning out the decedent’s home and making sure it is maintained until such time as it can be sold.

Also, the executor or administrator is responsible for preserving the decedent’s important documents, such as the birth certificate, social security card, marriage license, and divorce decree. Other documents such as tax returns, bank statements, and other financial records should be kept for seven years, either in hard copy or electronic form.

Wills can be contested on the grounds of undue execution, will had been revoked, the testator lacked testamentary capacity at the time of creation, or the testator was fraudulently induced to create the will, or undue influence was exerted upon the testator. Will contests are fairly common and can be costly and time-consuming to litigate. The person who challenges a will must have legal standing. This usually occurs when, for example, children are to receive disproportionate shares under the will, or when distribution schemes have changed from a prior will. Also, will contests often arise from disputes over who was designated as the executor.

Executors and administrators are entitled to statutory fees between 2% and 5%. SCPA §2307 lays out the statutory fees based on the size of the estate.

- For receiving and paying out all sums of money not exceeding $100,000 at the rate of 5%

- For receiving and paying out any additional sums not exceeding $200,000 at the rate of 4%

- For receiving and paying out any additional sums not exceeding $700,000 at the rate of 3%

- For receiving and paying out any additional sums not exceeding $4,000,000 at the rate of 2.5%

- For receiving and paying out all sums above $5,000,000 at the rate of 2 percent

Co-executors and co-administrators are each entitled to a full commission, but if there are more than two fiduciaries then the commission is shared. In addition to statutory fees, executors and administrators are reimbursed for all legitimate out-of-pocket expenses incurred while managing and distributing the assets of an estate.

Absent a binding contract or a personal guarantee that has been made with a decedent’s creditor, no specific person can be held accountable for paying a decedent’s debts. The obligation to satisfy all valid debts falls to the decedent’s estate, and those debts must be paid prior to the distribution of all assets to beneficiaries. So, the estate’s executor or administrator is charged with the responsibility of settling all debts from the estate’s funds.

An executor has a duty to carry out the terms of the will with scrupulous good faith and honesty. The executor must manage an estate’s assets capably and address all issues that may arise during the course of the estate’s administration. Although an executor is not required to hire an attorney, doing so may help to diminish the possibility of mistakes which might cost the executor or the estate money. And, yes, an executor may be personally liable should something go wrong with the administration of the estate.

The amount of the filing fee to probate an estate depends on the total value of the probate assets, though some assets do not figure into the value calculation, including jointly held real estate with rights of survivorship. Non-probate assets include retirement accounts and life insurance policies where a beneficiary was named.

A will must be probated in Surrogate’s Court in the county where the decedent had his or her primary residence. Additionally, if a decedent owns property outside of New York State, there must be an ancillary proceeding in that state – unless the out of state property is held by a trust.

If the decedent has less than $50,000 in personal property, the administration or probate process is eligible for a “voluntary administration,” regardless of whether the decedent did or did not have a will. The nominated executor, or the decedent’s closest living relative if the decedent died without a will, can file the “Affidavit of Voluntary Administration.” The voluntary administration proceeding is less complex than a full probate or administration proceeding because it allows the administrator or executor to proceed without the consent of the distributees, which can avoid will contest proceedings or other litigation. The person filing the affidavit is asking the court to let them collect the assets of the decedent, pay any of the decedent’s outstanding debts, and distribute property to the distributees as decreed by a will or the state’s laws of intestacy.

In New York State, the estate tax exemption is $5.85 million for 202o. Given the high New York State and federal estate tax exemptions, many estates are not subject to estate tax. In 2020, an individual can leave $11.58 million ($11.7 million in 2021) and a married couple can leave $23.16 million to their heirs or beneficiaries without paying any federal estate tax. This also means that an individual or married couple can gift this same amount during their lifetimes and not incur a federal gift tax.

An estate’s executor or administrator is responsible for overseeing an estate accounting, which is a document that details the estate’s assets at the time of the decedent’s death and how the estate funds have been spent since the decedent passed away. This estate accounting, presented to the beneficiaries, is meant to be a clear and concise review which will help the beneficiaries to understand why they are receiving particular assets. Typically, the beneficiaries will have questions regarding the executor or administrator’s transactions, and it is important that those questions be answered satisfactorily and in full. When this occurs, most estate accountings are approved by the beneficiary and the executor or administrator and final distributions can occur.