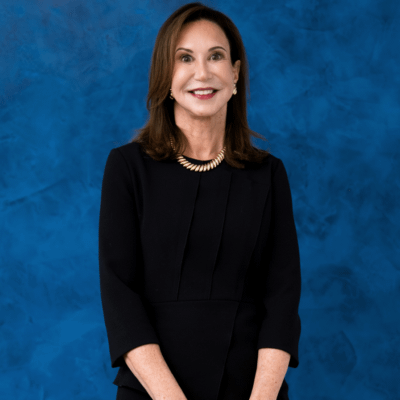

Meet Our Team

We are a boutique law firm with a large support staff that allows for quick response times, so you’re never left out of the loop.Our team features some of New York’s most prominent attorneys, including active members of the New York State Bar Association and the Katz Institute for Women at Northwell Health. Some of our attorneys also possess significant judicial experience in the State of New York. Known for our competence, kindness, and leadership, our attorneys are here to guide you and to ensure that your legacy is carried out just as you want it to be.

Testimonials

At Burner Prudenti Law, your needs always come first. Client satisfaction is our number one priority, and we are dedicated to ensuring every case is handled with care and efficacy. Hear what people have to say after working with us.

At Burner Prudenti Law, your needs always come first. Client satisfaction is our number one priority, and we are dedicated to ensuring every case is handled with care and efficacy. Hear what people have to say after working with us.

Our Mission

At Burner Prudenti Law, our mission is to help our clients plan for the future by setting up their estates in the best and most cost-effective way to maximize estate distribution in accordance with their personal wishes. By providing valuable and trusted legal advice in these critical areas, we seek to secure the best outcomes to protect our clients and their legacies. At Burner Prudenti Law, it is the client that matters most.