Latest News

A Lifetime in Law: The Career of Gail Prudenti and the Birth of Judicious Advice

From her time on the bench to her seven-year tenure as Dean of Hofstra Law School, Judge Prudenti has built a reputation for steady leadership and highly respected legal insight.

If you have been named as a trustee of someone’s trust, you may be wondering what you are supposed to do. It is important that the trustee understand their duties and responsibilities. The most important thing to remember as trustee is that the trust assets are not your assets.

In addition to traditional healthcare advance directives, such as a Healthcare Proxy and Living Will, the MOLST form is another directive one can execute to ensure their end-of-life wishes are followed. MOLST stands for “Medical Orders for Life-Sustaining Treatment.”

In June 2014, the United States Supreme Court unanimously found that IRAs that are inherited, are not protected from creditors in a bankruptcy proceeding because they are not considered “retirement funds” as interpreted by the Bankruptcy Code.

Question: My mother owns her home and is considering putting it into an irrevocable trust. She is concerned that if in the future she wanted to take a Reverse Mortgage on the property, she would not be able because the house is owned by a trust, is that correct?

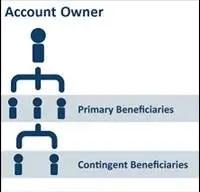

Question: I have recently rolled over my employer sponsored 401(k) plan into an existing IRA. I am not sure if I need to update the beneficiary designation forms on file; can you give me some advice?

Question: My mother applied for Chronic Care Medicaid to cover her stay in a nursing home facility. At the time of her application she had an individual retirement account (IRA) in the amount of $11,000.00 and $2,000.00 in her bank account. I was informed that the resource allowance for Medicaid is $15,900.00 (2021). However, my mother was denied Medicaid for failure to “maximize” her IRA. What does this mean and was the Department of Social Services correct in its determination to deny Medicaid?

Question: My mother has a trust that protects her house in case she needs long term care in a nursing home. Is this legal? Also, when she dies the trust is paid to another trust for me. Do I need this? I am only 53 and my mother is 75.

Question: I was named as an agent on my mother’s Durable Power of Attorney which included a “statutory gifts rider.” What is this document and what responsibilities will I have?

While the best elder law and estate plan is to have a valid health care proxy naming agents and a valid durable power of attorney naming an agent to make financial decisions, not everyone has done the proper planning. It is not uncommon for an elderly person to fall ill, be hospitalized and then need nursing home care with no time to plan.

A common question we get is, does Medicare pay for a nursing home? The Medicare program is administered jointly by the state and federal government. Medicare is available to adults 65 years of age and older, or to anyone under the age of 65 who is entitled to Social Security Disability.