Latest News

Hon. Gail Prudenti Selected as a Top Lawyer in Long Island

We're excited to announce that Hon. Gail Prudenti has be recognized by the Long Island Herald as a 2024 Top Lawyer of Long Island award recipient for her excellence in the Trusts and Estates practice area.

Congratulations to our partner Gail Prudenti who was honored at the Maurice A. Deane School of Law at Hofstra University 5th anniversary of the Pro Se Legal Assistance Program for her work in establishing the program while she was Dean of the law school.

With 10,000 baby boomers turning 65 every day, long-term care planning has become an increasingly important issue across the United States, including in New York. As the population ages, more individuals will require long-term care services and supports, highlighting the need for prudent planning to cover future care costs. There have been recent developments in New York on Medicaid eligibility rules and asset protection strategies.

If you're a trustee of a Medicaid Asset Protection Trust (MAPT) established by a loved one—such as a parent—you might wonder about the tax implications of this role, especially as Tax Day approaches. It's crucial to understand the nuances of tax reporting for these trusts to ensure compliance and avoid potential penalties.

After working most of your life and finally paying off your mortgage, the last thing you want is to see the assets you’ve accumulated through years of diligence fall into the government’s hands because you required long-term care either at home or in a nursing home. There is a way—a perfectly legal and legitimate way—to shield those assets and protect your children’s inheritance. But there’s no time to lose.

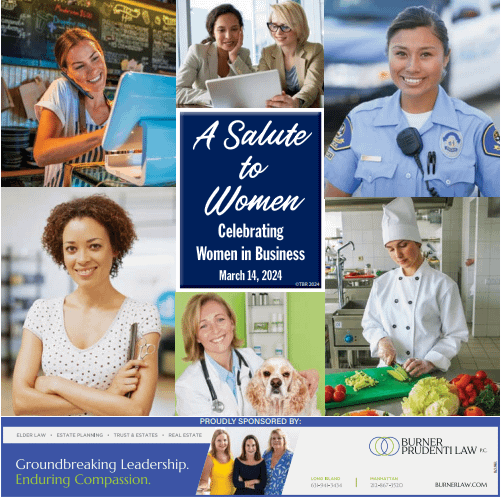

We are honored to celebrate Women's History Month by sponsoring the TBR News Media Salute to Women issue. This special issue celebrates the contributions and achievements of women in business.

According to multiple published reports, comedian Jay Leno is asking a California court to grant him authority over the financial affairs of his wife Mavis, who is apparently suffering from severe dementia.

In his first Law Day address, New York’s Chief Judge complained of the steady erosion of civics knowledge, and the resultant decline in civility, warning that, “The Framers knew that the consequence of constitutional ignorance, and being guided by passion rather than reason, was armed mobs.”

Many believe estate taxes are unavoidable upon death, but this isn't usually the case. In 2024, New York State has an exemption of up to $6,940,000, while the federal government's exemption is $13,610,000. Estates valued below these thresholds are not subject to estate tax.

Congratulations to our Partner, Hon. Gail Prudenti, for being named in Long Island Business News' Book of Business Influencers 2024, for the second year in a row!

We’re beyond honored to be to selected as the Best Law Firm in Dan’s Papers Best of the Best 2023 list for the fourth year in a row!

In The Media

-

Hon. Gail Prudenti Joins AHRC Nassau Foundation Board of Directors

As a member of the Board, Judge Prudenti will help advance the Foundation’s mission and ensure the long-term sustainability of programs that support children and adults with intellectual and developmental disabilities throughout Long Island.

November 15, 2023 -

Burner Prudenti Law, P.C. Recognized as Tier 1 Law Firm by Best Lawyers

We are honored to announce Burner Prudenti Law, P.C. has received a Tier 1 ranking in Elder Law in Long Island by U.S. News – Best Lawyers for the 2024 edition of “Best Law Firms.”

November 2, 2023 -

Burner Prudenti Law Attorneys Named 2023 Super Lawyers and Rising Stars

Four Burner Prudenti Law, P.C. attorneys have been included in this year’s Super Lawyers and Rising Stars lists for the New York Metro area. Super Lawyers, part of Thomson Reuters, is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high degree of peer recognition and professional achievement.

September 22, 2023 -

Matthew Kiernan, Former Suffolk County Public Administrator, Joins Burner Prudenti Law, P.C.

Burner Prudenti Law, P.C. is pleased to announce that Matthew Kiernan, Esq., former Public Administrator of Suffolk County as appointed by the Surrogates Court, has joined the firm as Counsel.

September 22, 2023 -

Nancy Burner and Britt Burner Recognized as 2024 Best Lawyers in America, Five Attorneys Named Ones to Watch

Nancy Burner and Britt Burner have been included in the 2024 edition of The Best Lawyers in America for the practice areas of Elder Law and Trusts & Estates. This is Nancy’s tenth consecutive year being honored for Setauket, NY, and Britt’s second year being honored, this year for New York, NY.

August 21, 2023 -

Burner Law Group Now Burner Prudenti Law, P.C.

Judge Gail Prudenti, Former Chief Administrative Judge for the State of New York, Joins the Firm, Expanding Its Trust & Estates Practice

August 17, 2023

Our Blog

There is much discourse about estate planning for married couples, but what about seniors who are widowed or have never married? Single people often have more complicated estates – especially if they do not have close natural heir such as a spouse or child.

A lien is a legal claim against real property by a creditor of the property owner, recorded in the county clerk’s office. The lien remains on the property until the property owner pays off the debt.

For the charitably inclined, there is always a question of how to be most efficiently leave money to charities in your estate plan. Charitable giving ranges from simple small monetary amounts to more complicated charitable trusts.

When residential property is owned by a trust, the trustee may sell the property if the terms of the trust permit it. The trust would be the seller of the property and the trustee must sign the listing agreement, contract of sale and closing documents.

The limited liability corporation, or LLC, is designed to combine the flexibility and simplicity of a basic partnership with the protection of a corporation. “LLC” stands for “Limited Liability Company” and owes its name to the fact that the members (owners) of the LLC are not personally liable for the debts and liabilities of the business.

Ever since the concept of individual land ownership emerged, passing real estate at death has existed in one form or another. Different states have different property laws that directly affect how real property passes at death.