Latest News

Do I Need Probate for a Small Estate?

The probate process can be lengthy, especially when a complex family tree is involved. Thankfully, the Surrogate’s Court provides a simplified alternative for “small estates,” through a process called Voluntary Administration.

New York’s Estate Tax law has just seen its most dramatic change in recent memory. Finally, the exemption has increased from $1,000,000.00 where it has remained since 2002, with the exemption set to increase annually until it matches the federal estate tax exemption in 2019.

Clients often ask this question and our answer is always the same, no matter how your property is titled it is still necessary to have a comprehensive Power of Attorney document in place. A Power of Attorney is a document in which a person (the Principal) can designate an Agent (an Attorney-in-Fact) to act on his or her behalf with respect to financial or legal matters.

Assuming your father meets the asset requirements for Medicaid, his income will not hinder his ability to qualify for Medicaid benefits. More importantly, he will be able to receive the homecare benefits without losing his monthly income.

This week’s column is a continuation of our column from last week where we answered questions regarding tax-deferred annuities, the different types and the tax benefits and consequences of purchasing or owning one. Included in the questions posed last week was “what are the Medicaid implications for the owner of an annuity.”

As an Elder Law attorney, many clients consult with me with regard to trust planning to protect assets from the cost of long term care. However, many clients do not realize trusts can also be used to protect assets for your children.

For every IRA you should complete a beneficiary designation form. Keep a copy of the form(s) among your important papers. Do not rely on the financial institution to keep copies.

Individuals who have received benefits under the New York State Medicaid program are subject to estate recovery for all assets passing through their probate estate. This is a minimum requirement under Federal Law.

The fact that your aunt has a diagnosis of Alzheimer’s disease, does not necessarily mean that she cannot execute a power of attorney. While it may seem like a decision to be made by her doctor, it is actually the lawyer who will determine if she or he feels your aunt has capacity.

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

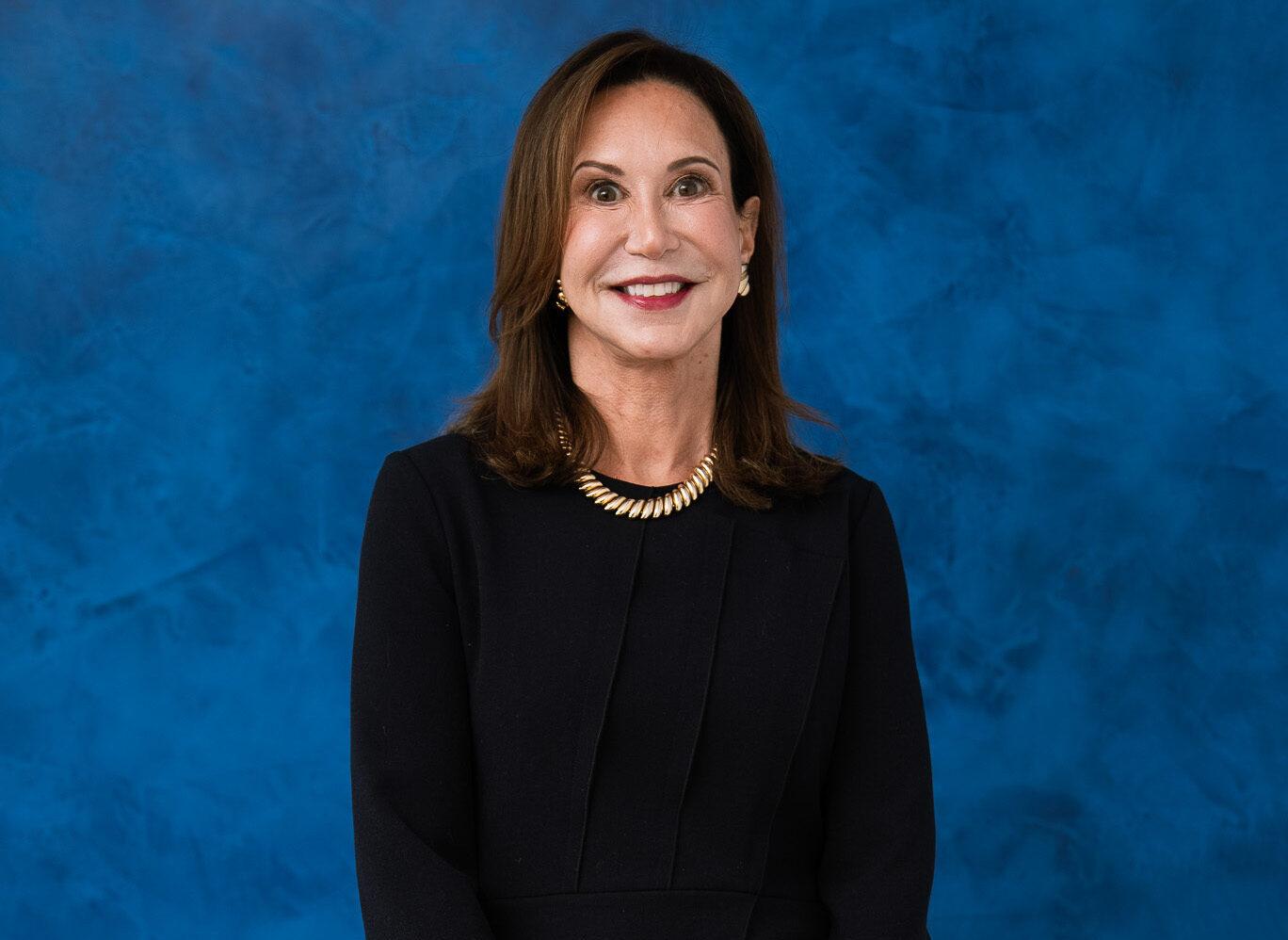

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

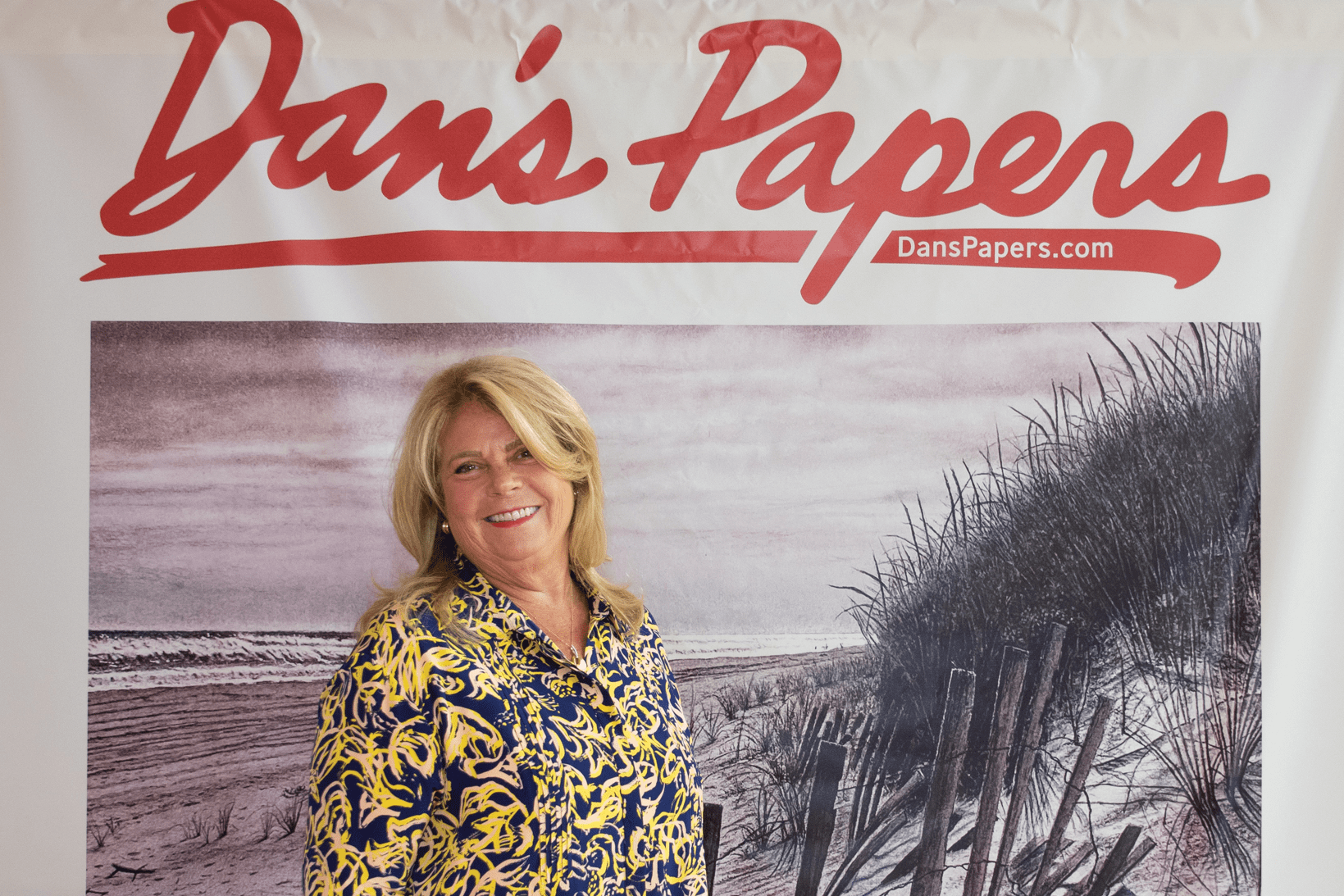

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?