Latest News

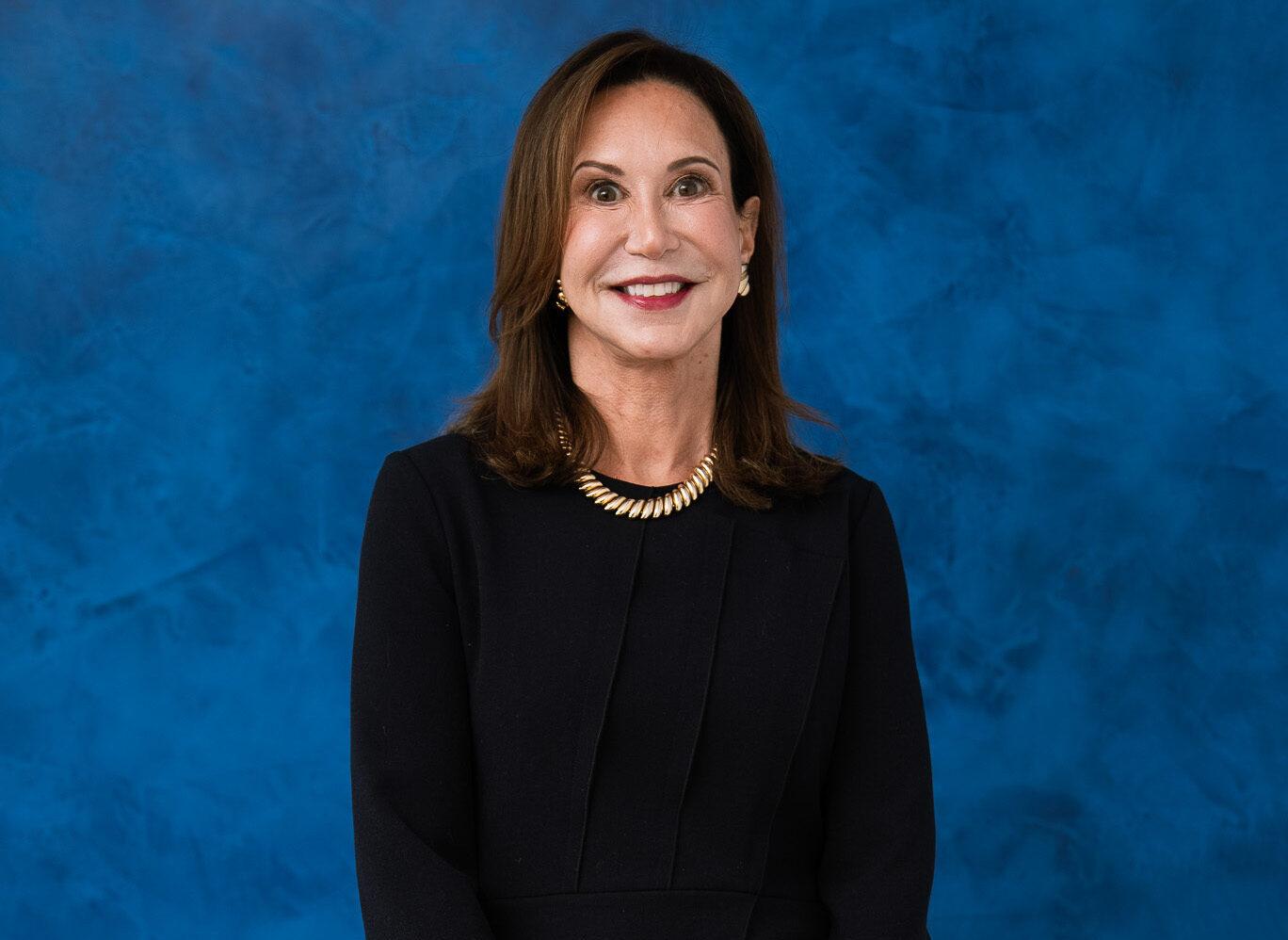

A Lifetime in Law: The Career of Gail Prudenti and the Birth of Judicious Advice

From her time on the bench to her seven-year tenure as Dean of Hofstra Law School, Judge Prudenti has built a reputation for steady leadership and highly respected legal insight.

Many of our clients have retirement assets held in a Traditional IRA, 401K, 403(b), or other similar plan. It is important to periodically review the beneficiary designations on these types of plans.

I have been living with my partner for the last 25 years. While I want to provide for him in my estate plan, I want to be sure when we are both deceased, my assets pass to my children from my first marriage. Can this be accomplished?

As the individual executing the health care proxy, also called “the principal,” you have the option to set an expiration date for your named agent’s ability to act. Whether your health proxy expires is a decision you must make at the time you sign it.

Much of the estate planning discourse revolves around planning techniques for the married couple, whether it be for tax planning or asset protection planning. However, for seniors who have never married or for those whose spouse is deceased, what, if any, special considerations need to be made?

My father executed a Power of Attorney and named me as the Agent. I was recently told by his bank that they would not accept my Power of Attorney, what are my options?

A few years ago my mom was diagnosed with dementia and recently she is having trouble paying bills on time. What is the best way for me to make sure the bills are paid?

For most of us, if the time ever came that we needed assistance, our preferred option would be to remain at home in our familiar setting surrounded by family. For many, the Community Based Long Term Care Program, commonly referred to as Community Medicaid makes that an affordable and therefore viable option.

My spouse recently passed away and I just learned that he disinherited me in his Will. What rights do I have?

My mother has Community Medicaid and she lives in her own home. Now the Managed Long Term Care provider, GuildNet, is leaving this area. What are my options? Will her hours of care be reduced? Should I be worried?

Once someone has been approved for Community Medicaid (home care benefits) or Chronic Medicaid (nursing home benefits) they will need to recertify with the local Department of Social Services each year. The recertification notice comes with an application that must be completed and sent in prior to the due date.

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?