Latest News

Who Qualifies for Community Medicaid in NY?

A New Yorker interested in applying for Community Medicaid – that is, long-term care provided by home healthcare aides – must meet certain income and asset limits to qualify.

My sister recently passed away and I just found out that I was named executor of her Will. I am really busy with my job and family and really do not want to serve. Can I decline or resign from being executor?

While discussing an estate plan with a client, she stopped me and said “What is probate.” Sometimes we forget to explain the simplest concepts. Probate is the process by which a Last Will and Testament is given effect.

I heard that there were changes to the STAR property tax relief program. Will I be affected? Does it matter that my house has been transferred into an Irrevocable Trust?

My dad signed a DNR when he was recently admitted to the hospital. Will this be effective when he is discharged back to his home?

My wife and I recently executed a Revocable Trust and re-titled our home and some bank accounts into the name of the trust, thinking that we had taken the first steps toward protecting our assets should one or both of us need Nursing Home care in the future. I just heard from a friend of mine that a Revocable Trust does not protect my assets and that what I should have considered was an Irrevocable Medicaid Trust, could you explain the difference?

I was recently named as an agent on my mother’s Durable Power of Attorney which included a “statutory gift rider.” What is this document and what responsibilities will I have?

I am listed as power of attorney on my mom’s bank account. Will I be able to access this money after she dies to pay for the funeral?

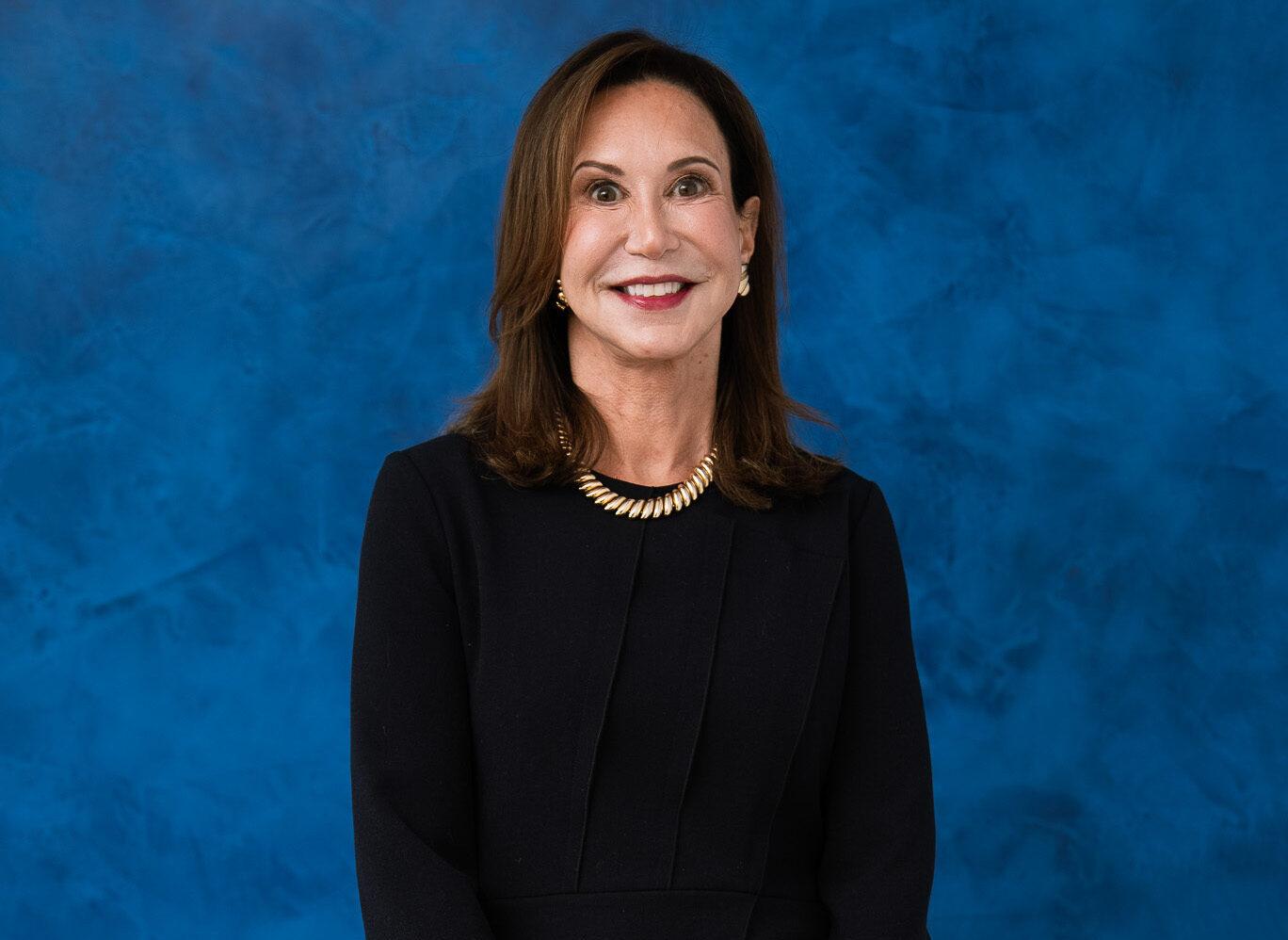

Nancy Burner, Esq., founder and managing partner of Nancy Burner & Associates, P.C., was selected by the Event Committee of Ride for Life to be recognized in the Business Category at the 19th Annual Honoree Recognition Benefit on March 15, 2016 held at Villa Lombardi’s in Holbrook.

Community Medicaid and Nursing Home (Chronic) Medicaid are two different programs that cover long term care. Community Medicaid will not pay for long term care in a nursing home. Community Medicaid is the program that covers care at home; such has a home health care aide.

I recently executed my will and other estate planning documents. I want to keep it in a secure location; however I am concerned that I may store it in a place where my executor cannot find it. What happens if the executor cannot find my will when I pass away?

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?