Latest News

Can You Decline Being an Executor?

An executor holds many important duties, and often must perform these obligations while navigating the grief of losing a loved one. Furthermore, complications such as advanced age or physical distance may make it difficult to perform the tasks required.

Does the Veterans Administration provide any benefits to receive assistance at home?

A designated beneficiary on a Transfer on Death (TOD) account has only an expectancy interest in the account and cannot use the funds in the account until the death of the account holder. With no present interest the designated beneficiary cannot withdraw funds for his or her personal use during the account holder’s lifetime.

I recently signed a Health Care Proxy naming my daughter to make healthcare decisions for me. Is she able to access my medical records and speak to Medicare and my supplemental health insurance company?

The Executor of an Estate is the individual named by the Decedent in his or her Last Will and Testament to act on behalf of the Estate. The Executor is entrusted with the responsibility of making sure the Decedent’s last wishes are carried out with regard to the disposition of the Decedent’s property, assets and possessions.

If I don’t need money from my IRA, do I have to take distributions?

It is not unusual for a client to contact me and ask to review their estate plan. This may be precipitated by a recent diagnosis or simply by the passage of time. I have a checklist that I use when reviewing an estate plan if they have a taxable estate.

Using an online service to prepare your will can result in costly mistakes and may altogether fail to properly transfer your assets. Even if you have a relatively simple estate and plan to leave all your assets to your spouse or children, an estate planning attorney provide for family situations that an online will cannot.

In my practice as an Elder Law attorney, clients often inquire about the benefits of gifting to reduce taxes or to qualify for Medicaid. As a senior with the unexpected need for long term care in the future, the consequences of gifting may have unexpected results.

What is probate? When a person dies and leaves a Will, and there are assets in the Decedent’s individual name that do not pass by operation of law, there is a legal process that takes place that is called probate.

Do I need a health care proxy? Could my husband make medical decisions for me if I couldn’t make them for myself?

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

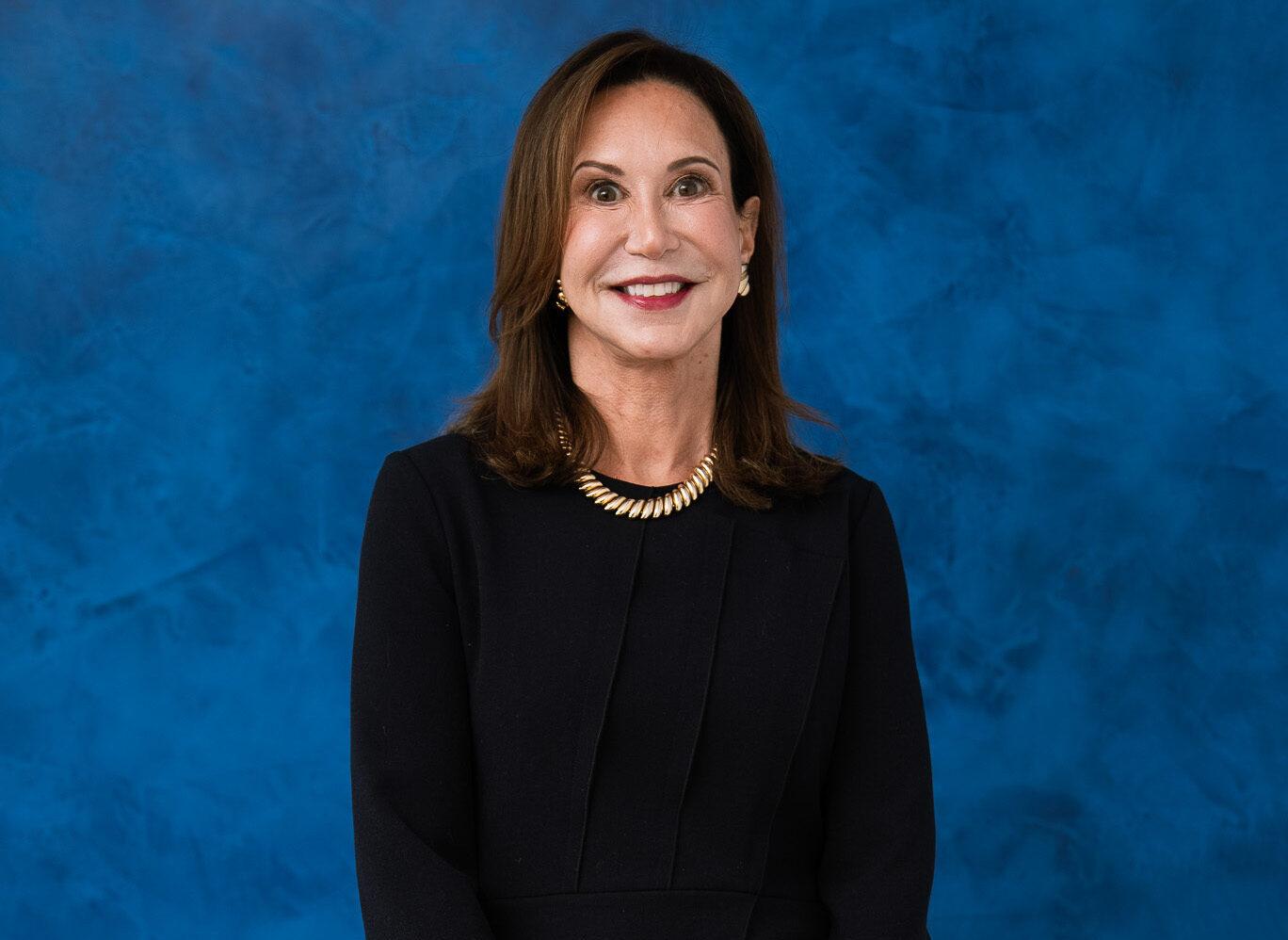

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

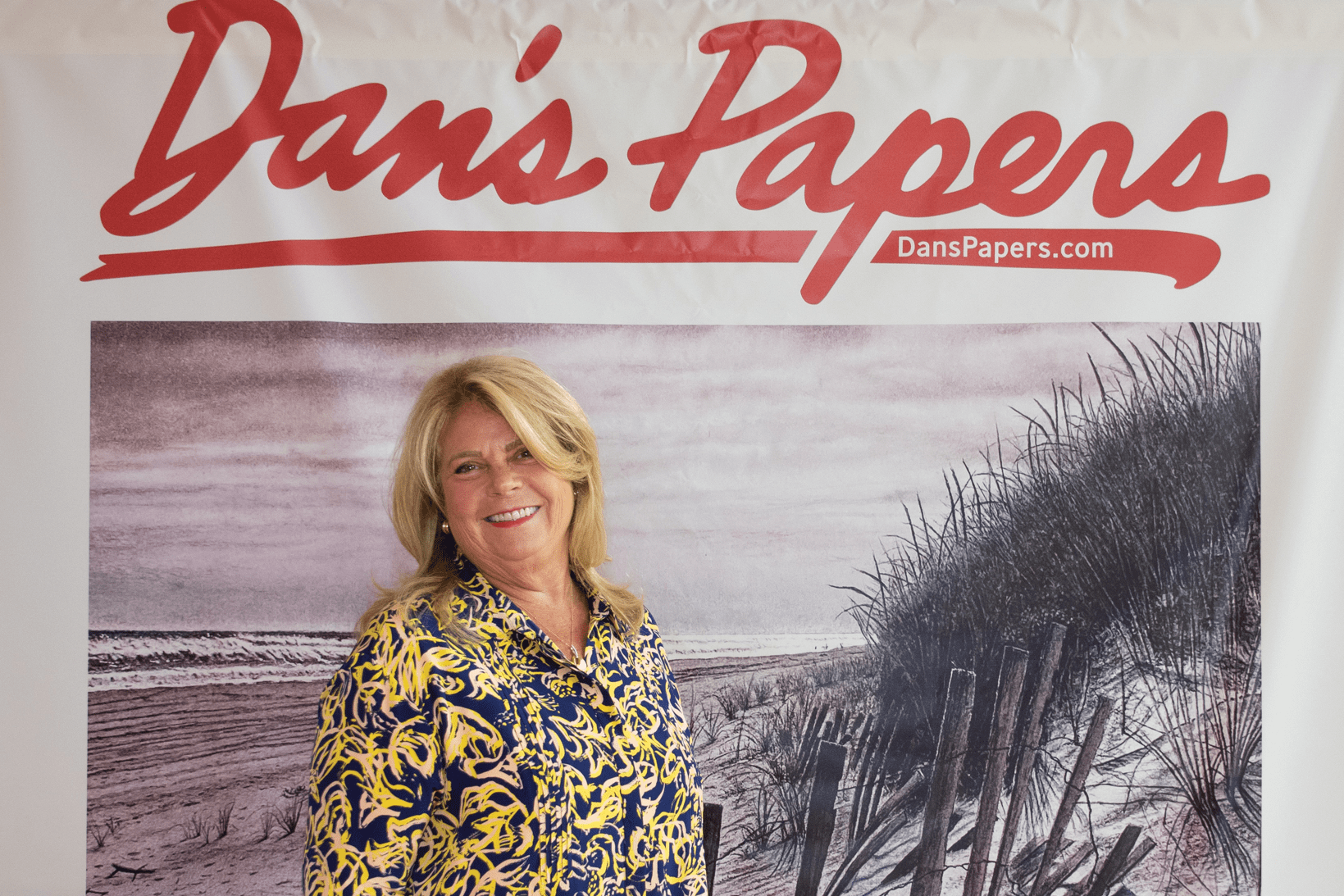

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?