Latest News

How Does Life Insurance Affect an Estate Plan?

Planning with life insurance requires the advice of competent insurance professionals and estate planning attorneys to ensure the most advantageous outcome for you and your beneficiaries.

In general, we suggest clients review their estate plan every five years or after a major life event. Such events include marriages, divorces, births, deaths, retirement, sale of your home, etc.

The Consumer Directed Personal Assistance Program (CDPAP) is a Medicaid program that allows a Medicaid applicant, or their representative, to choose the individual (or individuals) to provide care at home rather than using an aide from a home health agency.

If you happen to have a copy of your parent’s or grandparent’s Last will & Testament, it is likely that the estate plan was simple- everything to the spouse, then when the second spouse dies, everything to the children. We call these “sweetheart” or “I Love You” Wills.

Question: My wife suffers from Alzheimer’s. Currently, I am her primary caregiver, but I am worried that if I predecease her, she will need to go to a nursing facility. One of my friends suggested executing a new Last Will & Testament that disinherits my wife and leaves my estate to my children. Should I do this?

My mother recently passed away. She had two children, myself and my sister. Prior to her death, she had named my sister as agent under her power of attorney. My mother’s will treats both of us equally. I found out that a month before her death my sister used the power of attorney to change the beneficiary on my mother’s bank account to just herself. Was she allowed to do this?

Gifting and Medicaid planning is commonly misunderstood. We often see clients who believe that the gifting rules for Medicaid are the same as the IRS gifting regulations.

My mother has been in a rehabilitation facility for the last 6 weeks and will be discharged any day now. She is unable to care for herself and we desperately need help at home. I want to apply for Medicaid to help pay for the care, but I heard this can take months. Is there a way to get the care in place faster?

My sister wants me to sign a document that allows her to probate my mother’s will. The problem is that the will favors my sister, and I think the circumstances around the will are suspect. Is there a way I can get more information about the will signing?

Question: I have created a Medicaid Qualifying Irrevocable Trust and I am attempting to transfer my home to my trust. The bank which holds my mortgage has advised that they do not allow transfers to Irrevocable Trusts. Can they prevent me from protecting my house? What can they do?

Inheritance is the practice of passing property upon the death of a decedent. The rules of inheritance differ from state to state.

In The Media

-

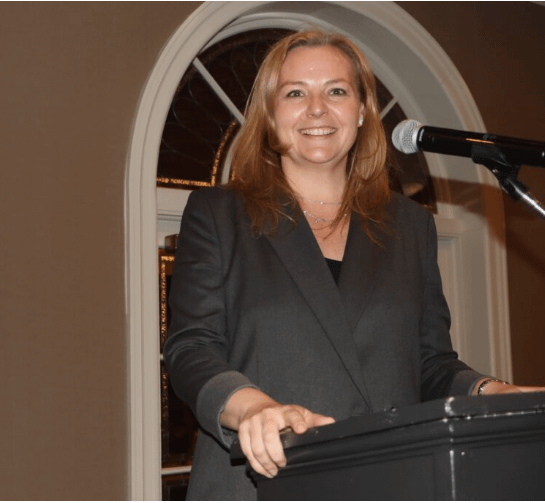

Estate Planning for Blended Families: Insights from Britt Burner

Britt Burner, Partner at Burner Prudenti Law, P.C., recently spoke at a Continuing Legal Education (CLE) event hosted by the Columbian Lawyers Association of Brooklyn

May 5, 2025 -

Matthew Kiernan Named a 2025 Top Lawyer of Long Island

Matthew Kiernan, Esq. was honored as a 2025 Top Lawyer of Long Island by RichnerLIVE Events and the Long Island Herald!

April 14, 2025 -

Burner Prudenti Named TBR News Media Reader’s Choice for Best Attorney / Lawyer

Burner Prudenti is honored to share that we were named the Best Attorney / Lawyer in the 2024 TBR Readers’ Choice issue!

March 31, 2025 -

Nancy Burner Recognized as One of Super Lawyers’ “Top 50 Women” For the Sixth Year in a Row

March 20, 2025 -

Burner Prudenti Law Ranked as a 2025 Tier 1 Elder Law Firm by Best Lawyers

Burner Prudenti Law was recognized as a 2025 Tier 1 law firm in elder law and trusts and estates by Best Lawyers!

November 6, 2024 -

Burner Prudenti Law Featured in Forbes & Fortune

Learn more about the history and vision of Burner Prudenti Law in this recent Forbes & Fortune article.

November 4, 2024

Our Blog

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?

In this guest post by Maria Torroella Carney, MD, FACP, learn what contributes to aging and what can be done to encourage healthy aging.