Latest News

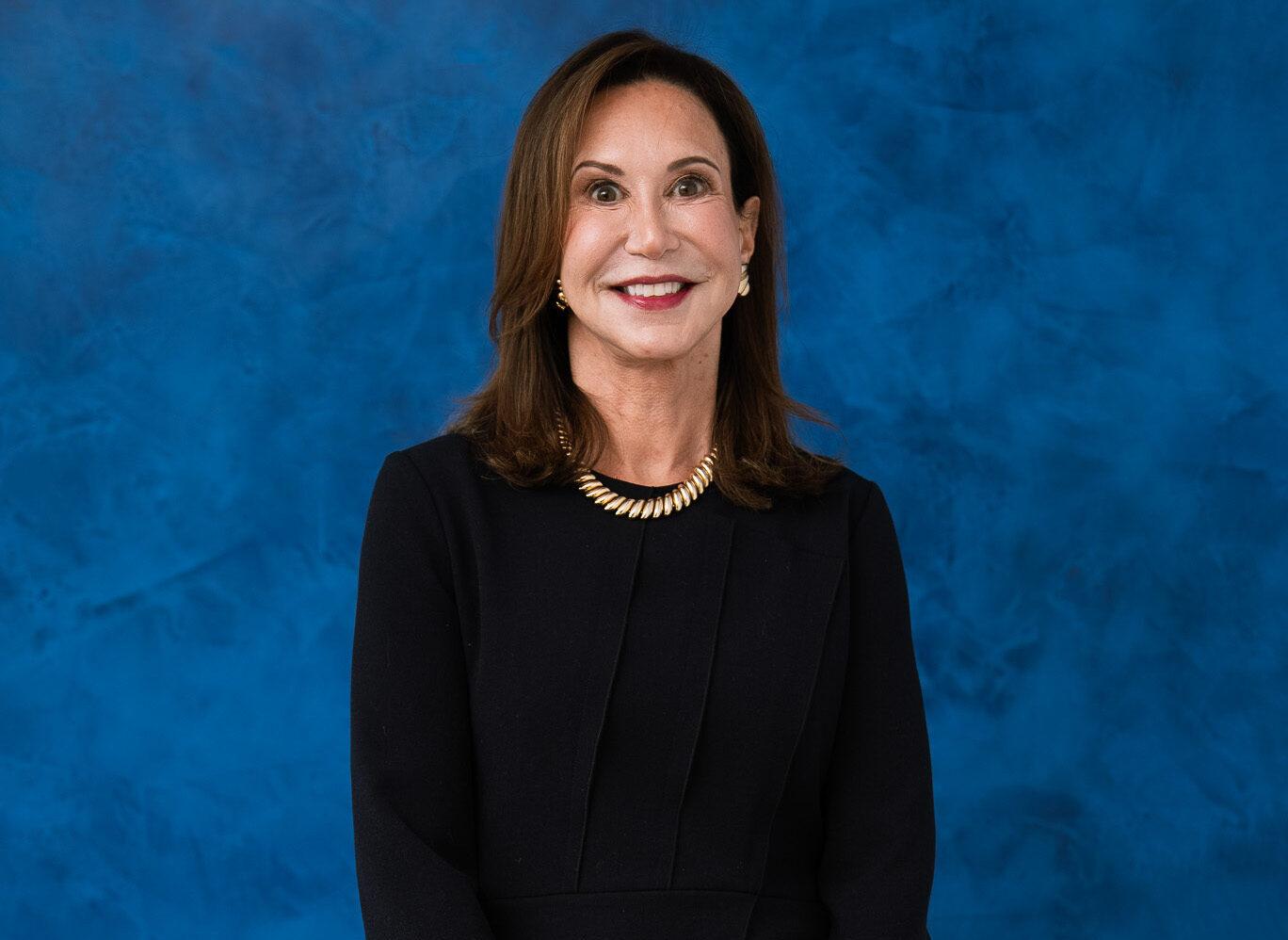

A Lifetime in Law: The Career of Gail Prudenti and the Birth of Judicious Advice

From her time on the bench to her seven-year tenure as Dean of Hofstra Law School, Judge Prudenti has built a reputation for steady leadership and highly respected legal insight.

One of the issues that we see facing many of our clients is an inability to implement and access services once an application for Community Medicaid has been filed and approved.

Young adults may have the misconceived notion that estate planning is only necessary for certain people, such as individuals of a high net worth or those who are aging. However, there are certain documents that everyone should consider, including the youngest generation of millennials.

I was named as the Executor in my mother’s Will. Do I receive a fee for serving as Executor of the Estate?

Do I need an estate plan if I have no assets?

Question: Someone told me to avoid probate, so I have added my two children as joint owners on my bank accounts or put them “in trust for” my children. Does this protect my assets from Medicaid too?

New York State’s Durable Power of Attorney is a document in which a person referred to as “the Principal” can designate another person or persons referred to as “Agents” to act on their behalf with respect to all business and financial matters.

Planning for the future can sometimes be difficult. Creating an estate plan can give you the peace of mind you need, while also making it easier for your loved ones to handle your affairs when you die.

Most veterans are not aware of the benefits they are entitled to under the Veterans Administration. For example, there is a benefit referred to as the improved Pension through the Department of Veteran’s Affairs (VA), more commonly referred to as Aid and Attendance Pension.

Spring cleaning has me thinking I may need to update more than my window treatments. What changes should I be making to my estate plan?

On March 31, 2018 the New York State Legislature and Governor Andrew Cuomo finalized the budget for the 2019 fiscal year. In January, the Governor’s office set forth a budget proposal.

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?