Latest News

Who Qualifies for Community Medicaid in NY?

A New Yorker interested in applying for Community Medicaid – that is, long-term care provided by home healthcare aides – must meet certain income and asset limits to qualify.

I heard Medicare will be issuing new benefit cards. Is there anything I need to do to order the new card or activate it once it comes in the mail?

This is a question we receive often. Navigating the maze of healthcare coverage can be confusing. For starters, a brief overview of the programs will help to demystify and clear some of the confusion.

I am the nominated Executor under my mother’s Will, which my sister is in the process of contesting. I understand that a Will contest may be a lengthy proceeding. Is there any way I can be appointed to act on behalf of the estate while that proceeding plays out?

In New York State, when a person turns eighteen, they are presumed to be legally competent to make decision for themselves. However, if a person is intellectually disabled or developmentally disabled, as defined by Article 17-A (“Article 17-A”) of the Surrogate’s Court Procedure Act, a parent or concerned relative can ask the Surrogate’s Court to appoint a guardian to assume the decision-making functions for that person.

My mother has been diagnosed with a terminal illness and has specific wishes with regard to end of life decisions. She executed a living will and a DNR during her last hospital stay; however, she is concerned that her wishes may not be followed. Is there any other document that would ensure her wishes are carried out?

The Tax Cuts and Jobs Act (the “Act”) increased the federal estate tax exclusion amount from $5 million to $10 million indexed for inflation for decedents dying in years 2018 to 2025. This amount is indexed for inflation back to 2011.

My mom has been approved for Community Medicaid and is eligible to receive a personal care aide in her home. I have been trying to schedule an evaluation with a Managed Long Term Care Company but I have been having some difficultly.

My mother is 87 years old. She is getting more confused each day and refuses to sign a health care proxy or power of attorney. What will happen if she becomes unable to manage her affairs?

There are many steps and layers associated with the administration of an estate. Ultimately, for most estates, the goal is to distribute the assets to the respective beneficiaries which are named in the decedent’s Will or are intestate heirs pursuant to the laws of intestacy.

What are the Medicaid Resource and Income levels? I was told they change every year and differ from County to County. Can you explain?

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

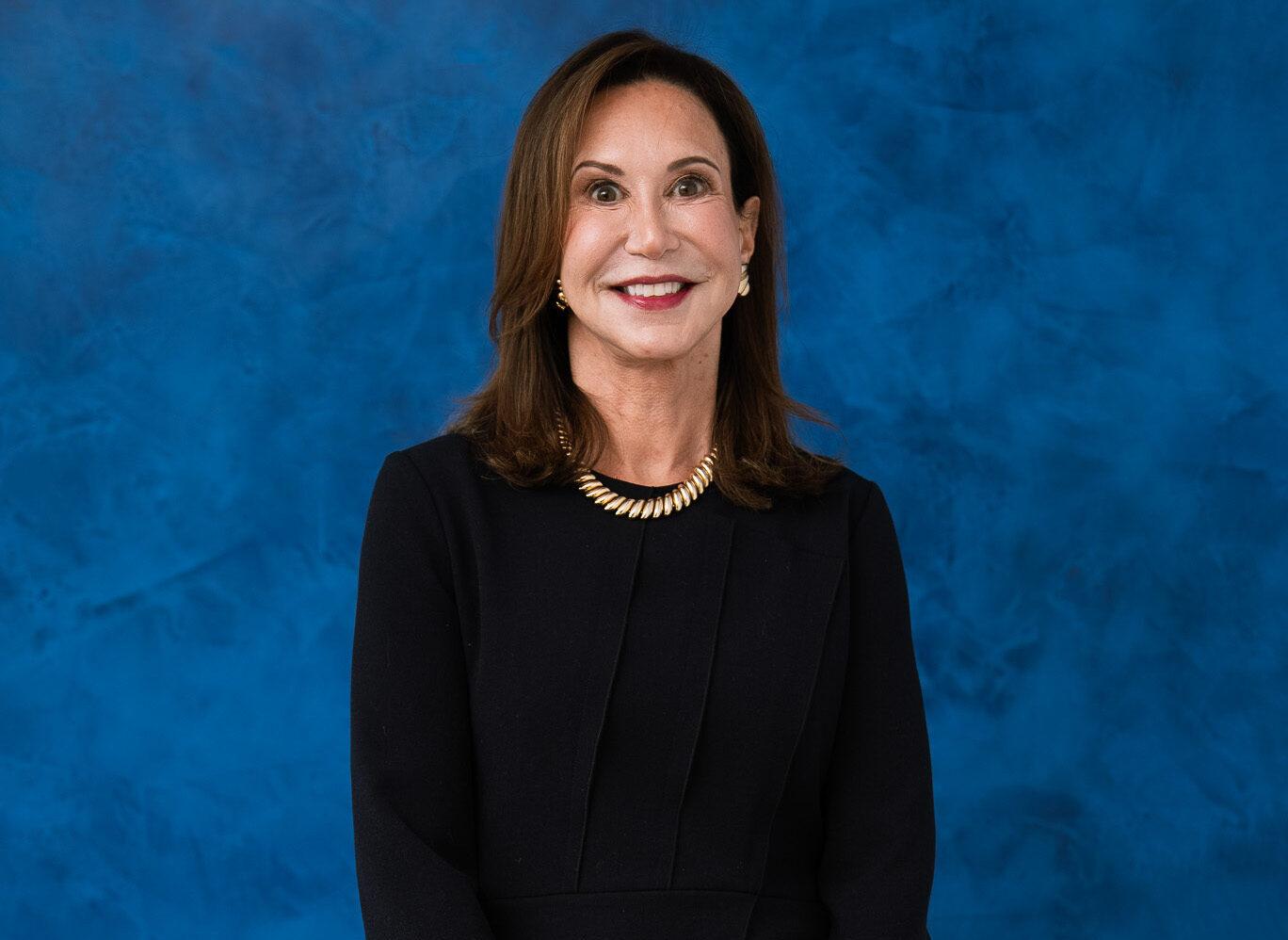

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

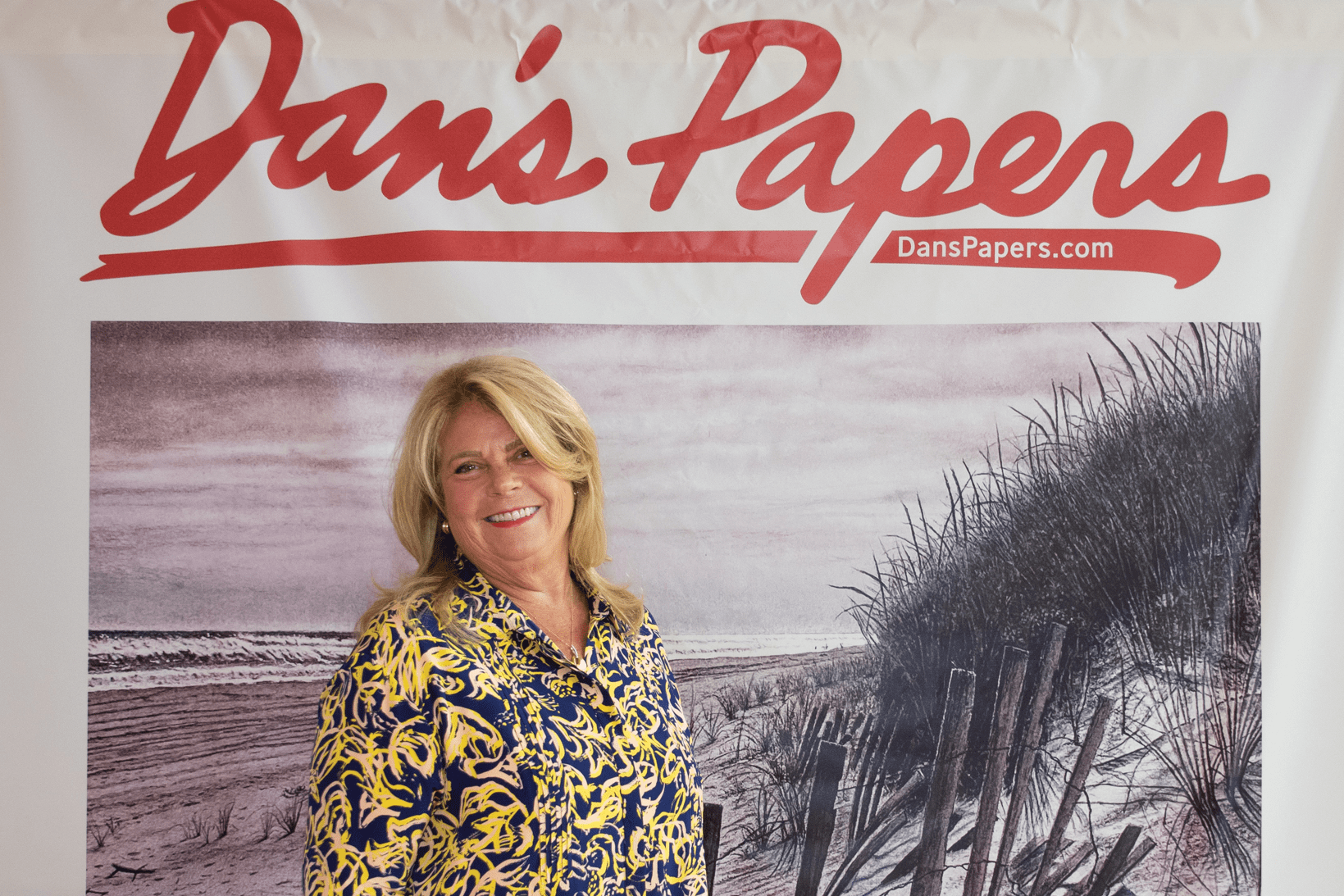

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?