Latest News

What Are the Signs That Someone Needs a Guardian?

In most cases, the need for guardianship does not arise suddenly. It develops quietly over time, as small warning signs begin to appear and slowly become harder to ignore.

The typical Medicaid trust is a grantor trust for income and estate tax purposes. The grantor trust rules came about after high earners tried to lower their income tax consequence by scattering their income to various trusts over which they maintained control.

The grantor trust rules came about after high earners tried to lower their income tax consequence by scattering their income to various trusts over which they maintained control. By spreading their income out, the earners were subject to the lower tax brackets.

Do all Wills have to go through probate?

I have three children. My son has been living with me for the past few years. I have heard that there is no reason for me to engage in any estate planning because if I require nursing home care, all of my assets can be transferred to my son. Is that correct?

Each January, the Governor of the State of New York puts out a proposed budget from which the Legislative and Executive branches will base their negotiations to determine a final budget. The budget is set to be passed by March 31; the date that marks the end of the fiscal year for the State.

years ago, my mother signed a General Durable Power of Attorney and named me as Agent. I was recently told that there is a possibility that the Power of Attorney may not cover all transactions. Could that be true?

I read somewhere that the New York State Estate Tax Exemption was increasing again this year, could you explain this to me?

My mother passed away with $20,000 in credit card debt. As the Executor of her estate, am I liable for these bills?

My son has developmental disabilities and, as a result, is unable to make enough money to support himself. He only has a savings account with $25,000 in it; is there any government assistance available for him to receive some income?

I keep hearing that if I apply for Medicaid I will need five years’ worth of financial documents. Could you tell me what are the documents I should be keeping?

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

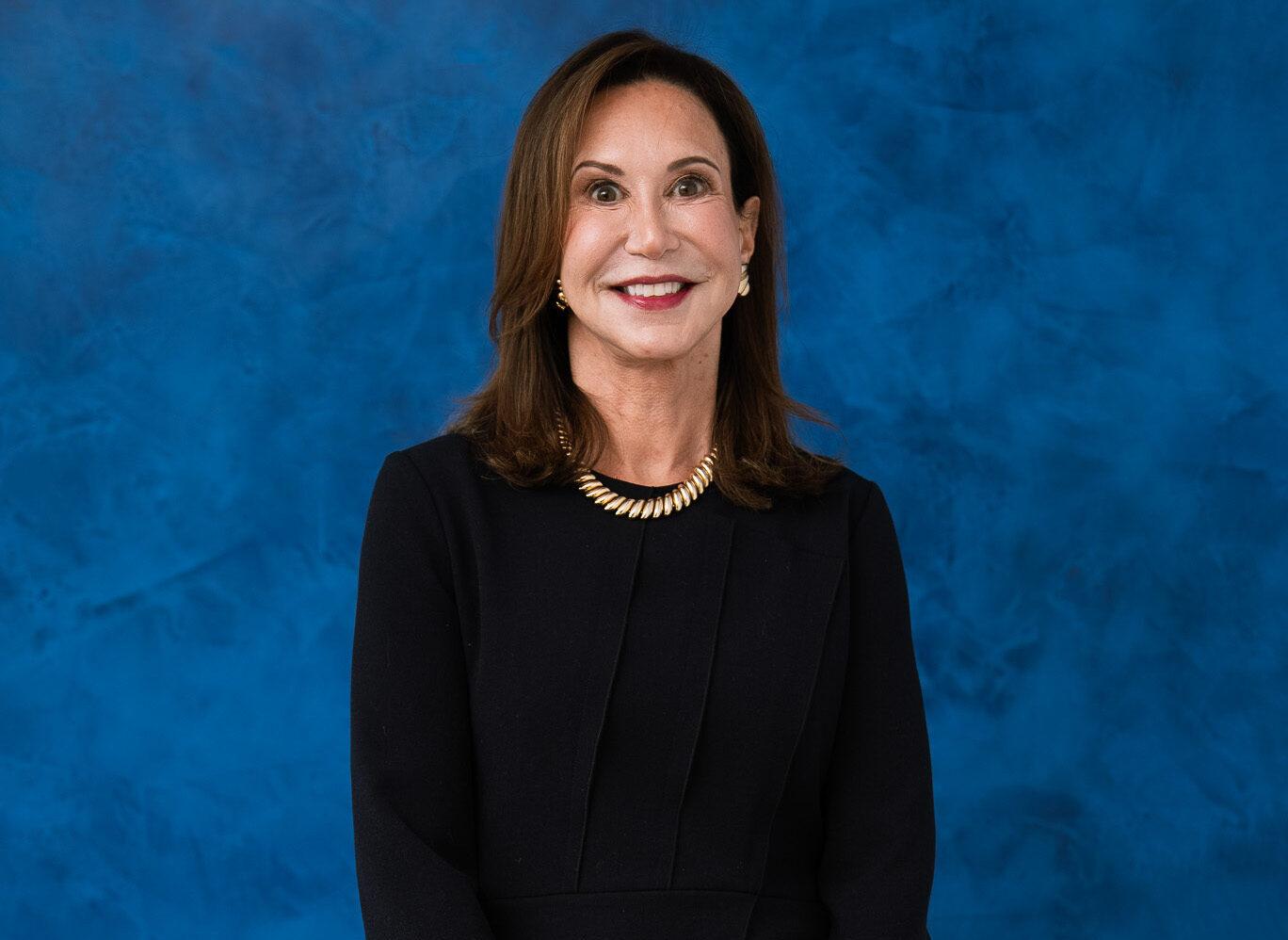

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

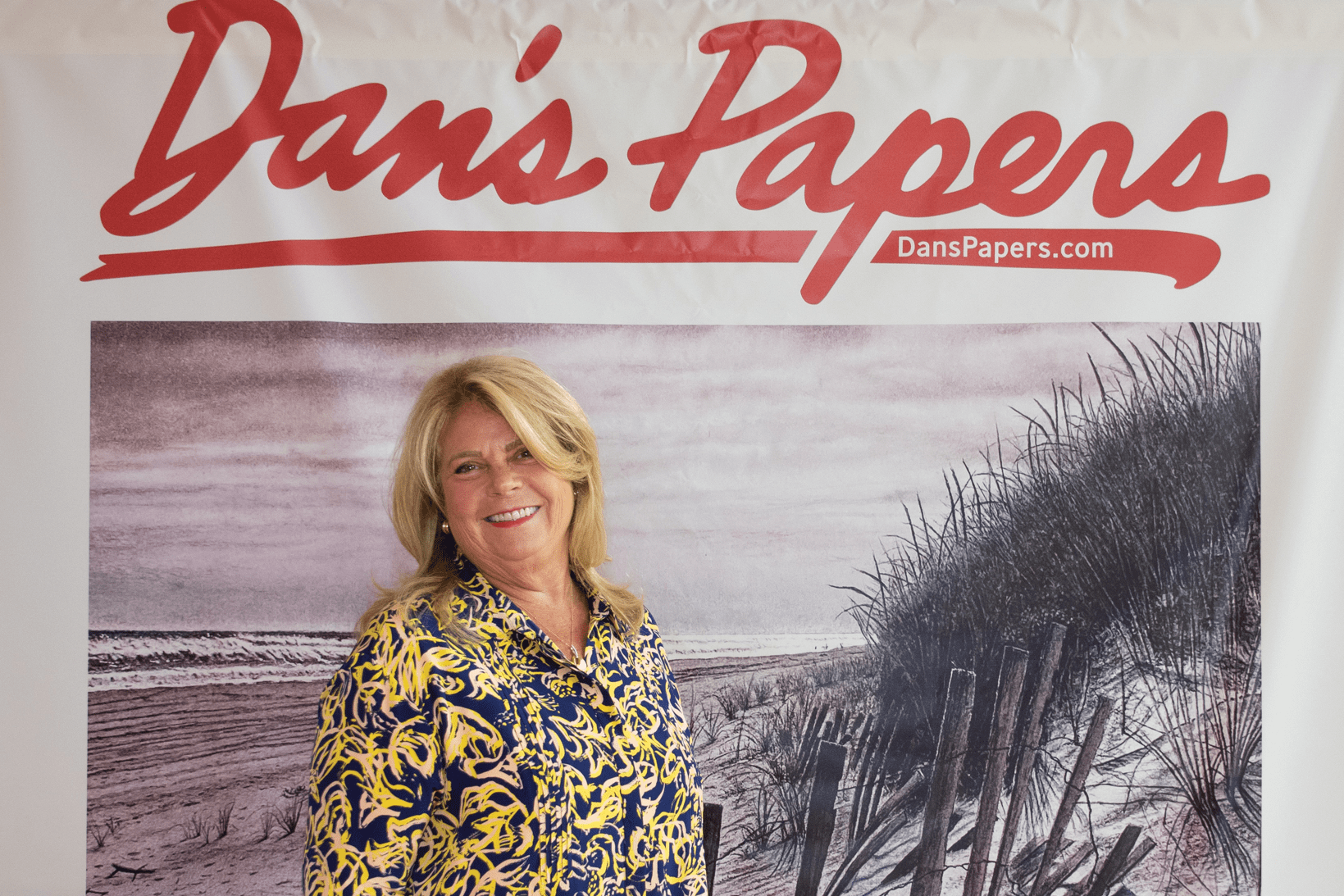

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?