Latest News

What Might Be Missing From Your Trust?

Probate is often triggered not by major assets, but by small details that were unintentionally overlooked.

Minors cannot be left assets outright in New York. Minor beneficiaries must inherit in trust. If a minor inherits outright, a guardian must be appointed by the Surrogate's Court.

Many people think that once they sign a will or a trust, all of their assets will follow those instructions. The truth is that certain accounts do not go by what your will says.

Without a succession plan, a business owner’s family and/or co-owners are forced to make quick and stressful decisions. Having a procedure in place is invaluable.

MOLST forms and DNRs should be a topic of discussion when considering your advance directives, but it’s crucial to note that they are not legal documents.

While some Medicaid programs do allow recipients to own a primary residence, it is crucial to plan to protect your home.

As a legal adult, no other person, including your parents, can make health care decisions or manage money for you without the right legal documents in place.

An ABLE account is one solution of many for individuals eligible for government benefits looking to protect their benefits and preserve assets.

The Consumer Directed Personal Assistance Program allows those who need a caregiver to recruit and hire someone of their choice to assist them with daily needs.

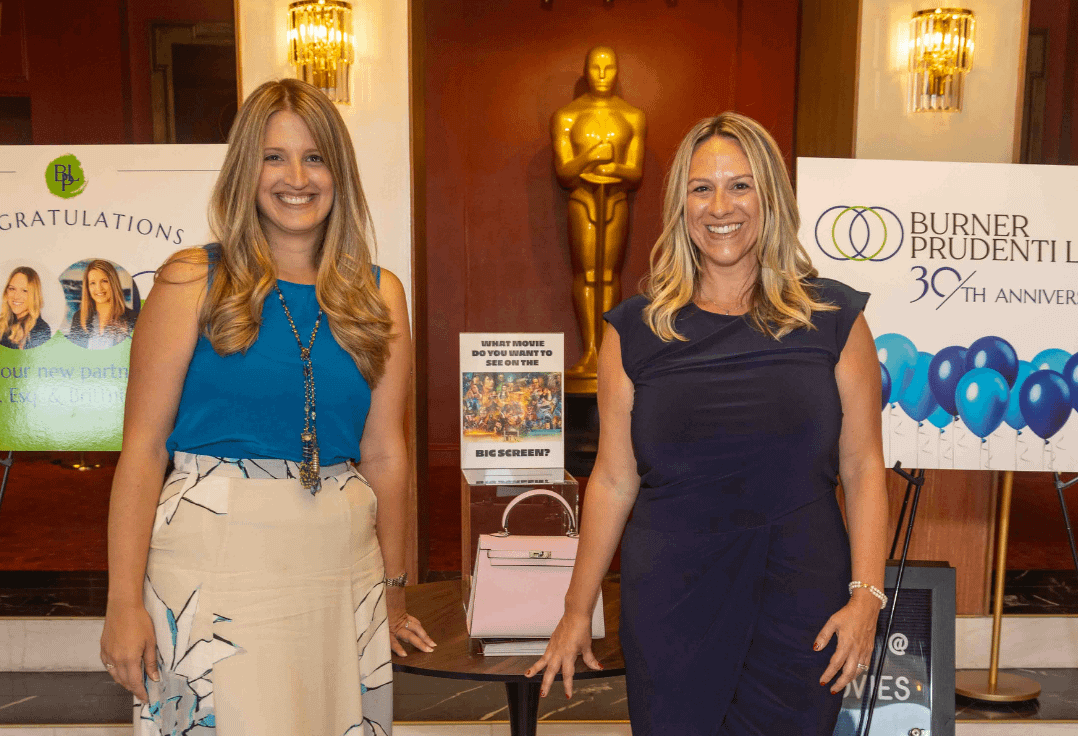

Burner Prudenti Law, P.C., a women-owned Elder Law, Estate Planning, Trusts & Estates and Real Estate firm serving New York for over 30 years, is proud to announce the promotion of Brittni Sullivan, Esq. and Melissa Doris, Esq. to Partners.

With the busy lives of a young family, planning for a scenario that might never happen may be at the bottom of the to-do list, but no one knows what odds they are up against.

In The Media

-

Burner Prudenti Law Honored as One of Best Lawyers 2026’s Best Law Firms

Burner Prudenti Law is proud to share that our firm has once again been recognized by Best Law Firms® for excellence in Elder Law and Trusts and Estates, earning both national and metropolitan Tier 1 rankings.

November 6, 2025 -

Burner Prudenti Law Attorneys Named 2025 Super Lawyers and Rising Stars

Burner Prudenti Law is proud to announce that several of our attorneys have been recognized by Thomson Reuters for the 2025 New York Metro Super Lawyers and Rising Stars lists.

October 30, 2025 -

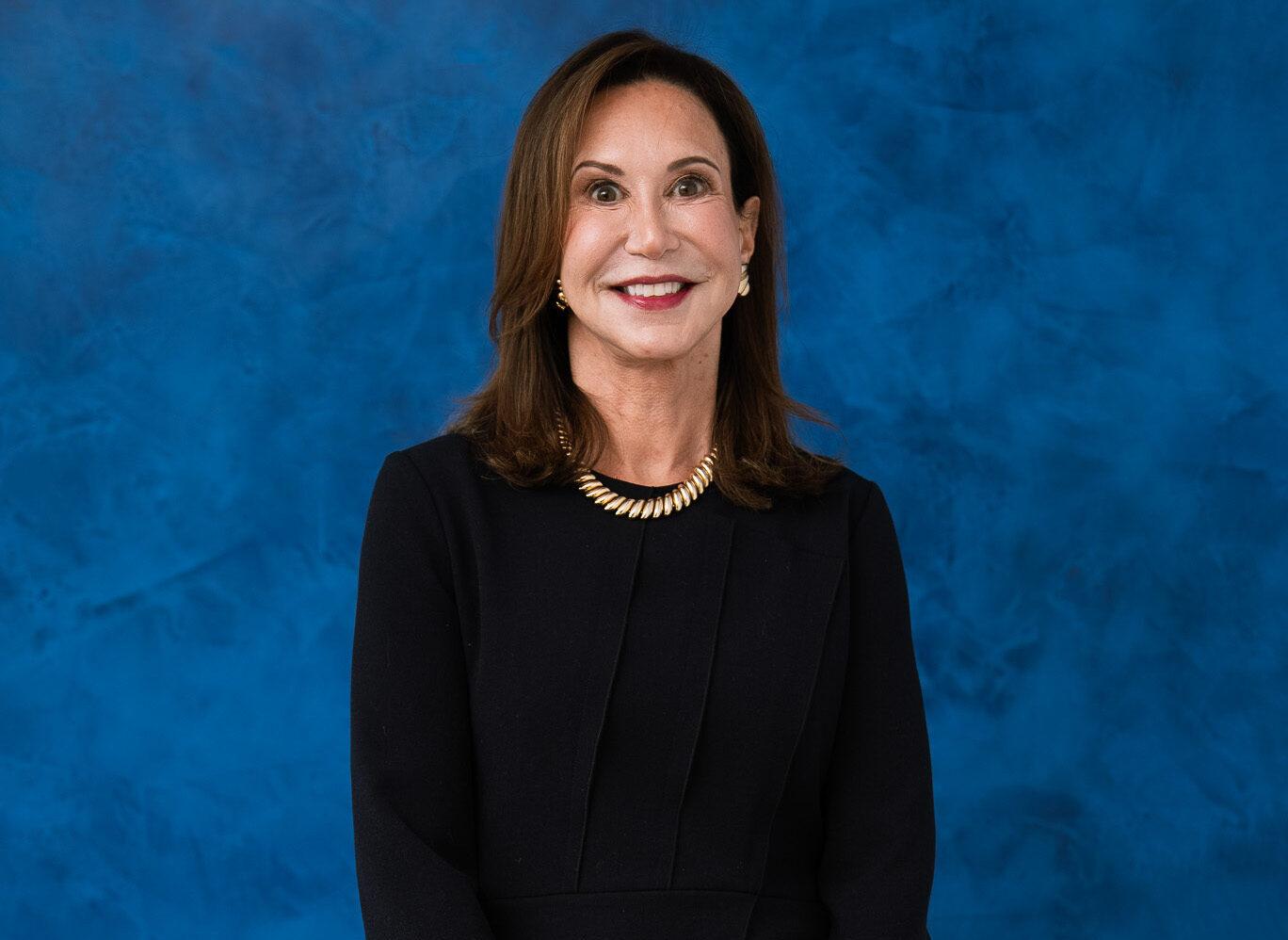

Hon. Gail Prudenti Named 2025 Leaders in Law Honoree

We are thrilled to share that our partner, Hon. Gail Prudenti, has been named a 2025 Leaders in Law honoree by Long Island Business News!

October 9, 2025 -

Hon. Gail Prudenti Named to Long Island Business News’ 2025 Influencers in Law

We are proud to congratulate our Partner, Hon. Gail Prudenti, on being named to the Long Island Business News 2025 Influencers in Law.

October 2, 2025 -

Burner Prudenti Law Named to Long Island Business News’ In the Lead: Women-Owned Businesses

Burner Prudenti Law, P.C. is honored to be recognized by Long Island Business News as one of the 2025 In the Lead: Women-Owned Businesses.

September 22, 2025 -

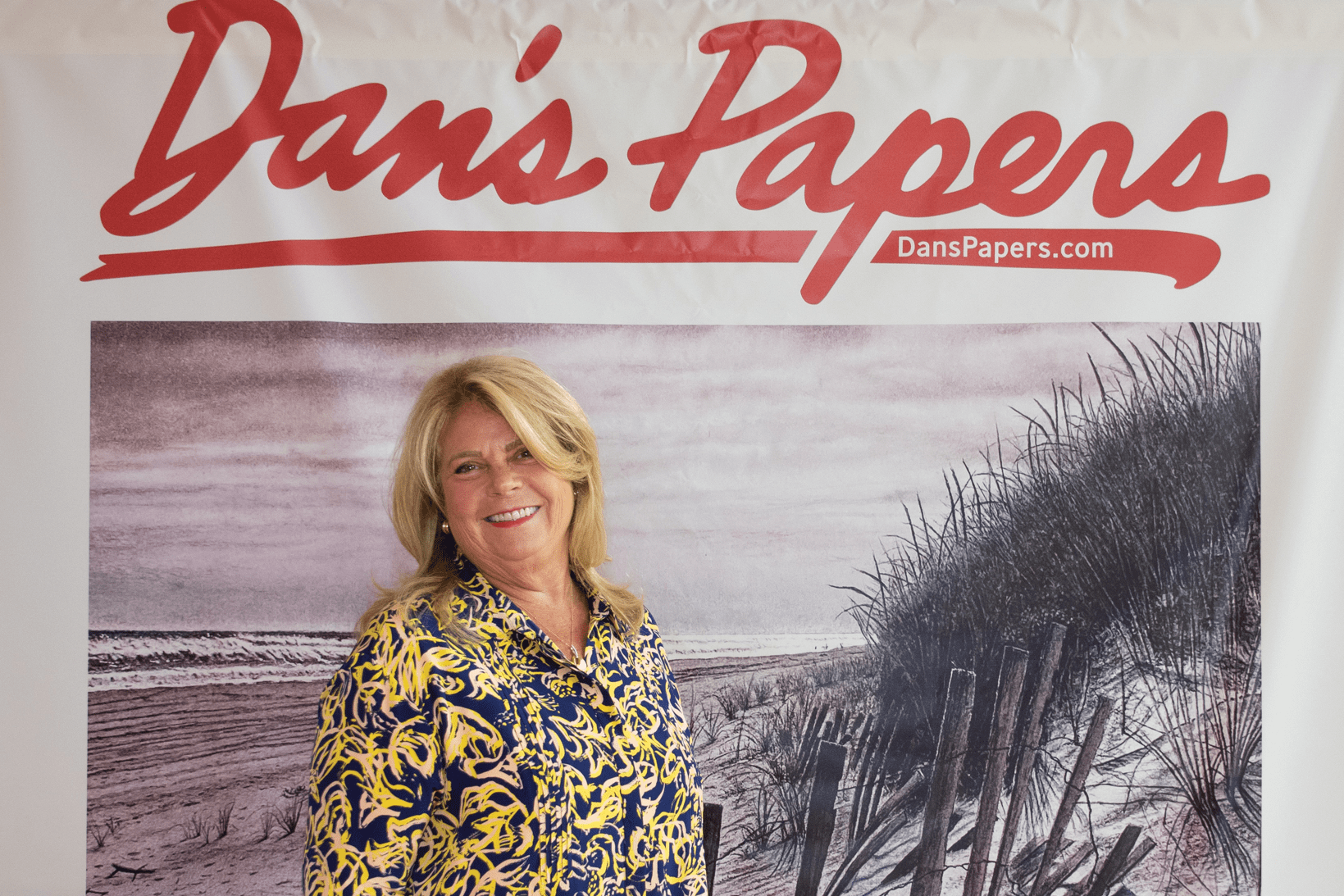

Burner Prudenti Law Featured in Dan’s Papers

Burner Prudenti Law was recently featured in Dan’s Papers, offering readers an in-depth look at our growth over the past 30 years.

August 27, 2025

Our Blog

We’re proud to share that our Partner, Hon. Gail Prudenti, has written a featured column for Long Island Business News titled “Understanding New York’s Court of Claims.”

In the landmark case of Connelly v. United States, the Supreme Court addressed critical issues concerning the estate tax implications of life insurance proceeds used in the redemption of stock in closely held corporations.

Our criminal courts protect victims. Our civil courts provide a forum for the peaceful resolution of disputes. Our family and surrogate’s courts guide families through what may be the most traumatic experience of their lives.

As we reflect on the complexities of family law, let us work together to support our justices, understanding the weight of their responsibilities and the importance of their decisions.

The Medicaid Asset Protection Trust (“MAPT”) is alive and well in the Elder law practitioner’s toolbox and is the best option for protecting real property.

The federal government and the marketplace are undergoing revolutionary changes that will inevitably transform the business of law and operation of courts. The question arising from the uncertainty is, how so?